Medicaid Lawyer

Are you worried about the long-term care costs for your aging parents, spouse, or yourself?

Even if you exceed the income and asset eligibility guidelines set by Medicaid, you may still qualify for benefits.

At Selis Law Firm in Palm Coast and Ormond Beach, FL, our Medicaid lawyer can help you afford nursing home care.

Does Your Loved One Need Long-Term Care?

Medicaid Planning Can Help

Did you know that one of the greatest threats to your financial stability is the need to put a loved one in a long-term care facility due to old age? Even with careful retirement planning, most middle-class families simply aren't prepared to pay the high cost of putting a loved one in a long-term care facility. Unfortunately, many people aren't aware that they can plan for this early on; had they known, many seniors would have met with attorney Scott Selis earlier to start planning their future long-term care needs. Our clients can learn more about their options at extremely reasonable rates.

We serve clients from Flagler County, Volusia County, and other areas of the state. Contact our elder law attorney online to ask a question or request a consultation. You can also reach our Daytona Beach-area offices in Ormond Beach and Palm Coast at:

(866) 735-3377

5-Star Google Reviews "I Had No Worries about Anything."

I had the need for a law firm that specialized in elder law as my wife became very ill and was placed into a nursing home under hospice care. Several persons within the health care field recommended only Selis Law and no other firms to handle my needs. I then contracted with Selis and was very happy with the efficient handling of all the requirements needed with placing my wife into Medicaid. I have engaged many attorneys and law firms throughout my life and highly recommend Selis Law to anyone who may need the services of a law firm dedicated to servicing the elderly.

View on GoogleOur family has been a client of Selis Elder Law of Florida for the past three years. We actually followed Scott Selis from another law firm because of Scott Selis' expertise and compassion. A couple of his expert staff went with Scott when he opened his own law firm. This says a lot about his character and integrity. Scott's guidance in creating two trusts for our family made it easy and he answered very question that we had. If you or your family needs an Elder law firm we highly recommend Selis Elder Law of Florida. You will be very pleased with the care that he and his staff show you and most importantly the results.

View On GoogleThe Cost of Nursing Home Care in Florida

According to the Genworth Cost of Care Survey, the median cost of assisted care in Florida in 2020 was:

| In-Home Care | Monthly Cost | Annual Cost |

| Homemaker Services | $4,195 | $50,340 |

| Home Health Aide | $4,290 | $51,480 |

| Community and Assisted Living | Monthly Cost | Annual Cost |

| Adult Day Health Care | $1,408 | $16,896 |

| Assisted Living Facility | $3,700 | $44,400 |

| Nursing Home Facility | Monthly Cost | Annual Cost |

| Semi-Private Room | $8,669 | $104,028 |

| Private Room | $9,817 | $117,804 |

The reality is that paying for this care can completely deplete a family's savings. However, there are options for working class and middle class families. Medicaid is a needs-based program that covers the cost of assisted long-term care. However, in order to qualify, you must meet the program's income, asset, and medical need requirements.

If you don't qualify at first glance, our lawyer at our Ormond Beach and Palm Coast offices can assist you in the financial planning, asset protection, and application process so you have a better chance of getting Medicaid benefits to cover the cost of long-term care.

Why Hire Medicaid Lawyer Scott Selis?

Help for the Middle Class

What can be extremely frustrating about the long-term care system is that it tends to benefit the very wealthy or the very poor. The wealthy can afford to pay the exorbitant costs of care and those with lower income and asset levels can qualify without any Medicaid planning. Unfortunately, the working and middle class are often left to fend for themselves.

High Level of Planning

There are several different state guidelines and regulations that must be considered when determining how to reorganize your income and assets. Our elder law attorney makes sure all assets are correctly titled and that excess income and assets are diverted in a legal manner that is compliant with Medicaid's guidelines.

Quick Turnaround

Many people think that they have to wait months to access money, but we can often get benefits within two to eight weeks. For many patients, this fast turnaround can help them maintain their financial stability.

Getting It Right

While our attorney is able to achieve quick turnarounds in many cases, this isn't always the best scenario for all clients. For some, time is not as high of a priority. We take the time to fully analyze your elder law case to get the best result.

Help for the Whole Family

Whether you are seeking help for your parents, spouse, or yourself, our attorneys can help you seek Medicaid benefits for long-term care.

Financial Strategies

We can include specific legal wording in your estate plan, provide advice on where to put excess income and assets, and retitle and restructure your assets. We may also recommend a trust. Having a careful strategy in place can enable you or your spouse to qualify for Medicaid if the need for long-term care becomes necessary.

Remote Service

Many people think that they need to physically come into our Daytona Beach-area offices in Ormond Beach and Palm Coast to proceed with their case. In fact, we can handle your Medicaid planning case remotely, from start to finish. We take on these types of elder law cases for clients throughout Volusia County and the entire state.

Preserve Finances

By putting these financial strategies in place, our elder law attorneys can help families preserve their savings so they can be passed down to the next generation. This gives our clients a greater sense of control and peace of mind when it comes to the difficult decision to put a loved one in nursing home care.

Choose the Facility You Want

Most nursing homes accept Medicaid, so you have the freedom to choose the facility that is best for your loved one's needs. To help make your decision easier, the government rates nursing home facilities, and there are many 5-star options available.

Contact us online to ask a question or request a consultation. We serve clients in Daytona Beach, Flagler County, Volusia County, and throughout the state from our Ormond Beach and Palm Coast offices.

More 5-Star Google Reviews

We were very happy with the all the guidance and advice we received from Selis Elder Law. During the midst of Covid my sister-in-law moved here, got sick and ended up in a nursing home. Selis Law directed us to ensure that our family member will be protected financially. The staff is caring, efficient, and knowledgeable.

View On GoogleWonderful Attorney's office. They have the utmost knowledge of estate planning whether you are a snowbird like myself or year around resident. I would highly recommend this firm to anyone interested in the best in Estate planning. They have an excellent knowledgeable staff as well.

View On GoogleMedicaid Nursing Home Eligibility Requirements

The State of Florida will review your financial documents and medical reports to determine if your loved one qualifies for Medicaid benefits.

1. General Requirements

Must be a resident of Florida

Must be a US Citizen or Legal Resident Alien

2. Income and Asset Requirements

| Single | Married (both spouses applying) | Married (one spouse applying) | |

| Income Limit | $2,382/month | $4,764/month (Each spouse allowed up to $2,382/month) | $2,382/month for applicant |

| Asset Limit | $2,000 | $3,000 | $2,000 for applicant & $130,380 for non-applicant |

| Level of Care Required | Nursing Home | Nursing Home | Nursing Home |

According to the American Council on Aging's 2021 Florida Medicaid Long Term Care Eligibility for Seniors.

Included Assets

When calculating assets, the state includes the following assets:

- CDs

- Stocks

- Bonds

- Checking accounts

- Savings accounts

- Second homes

- Vacation homes

- Anything more than one motor vehicle

Protected Assets

The following assets are excluded from the asset calculation.

- Your primary home

- One vehicle

- Pre-purchased funeral plans

- Personal property

- Household belongings

- Life insurance policies under $1,500

- Up to $1,500 in cash going toward burial expenses

- Certain types of trusts, such as the Medicaid Asset Protection Trust

3. Medical Need Requirements

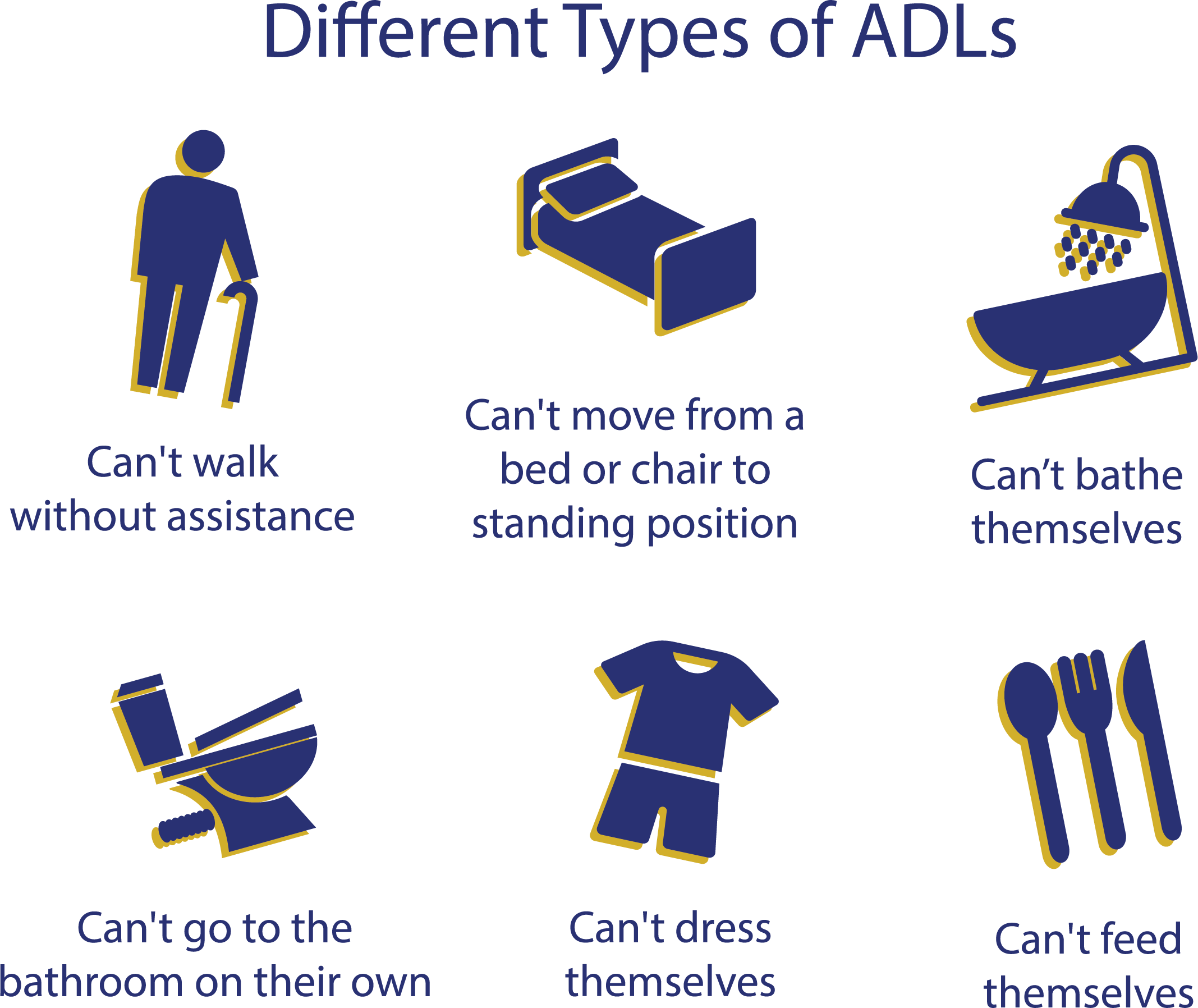

To qualify for Medicaid, the state must review the medical records and needs of the patient. Specifically, Activities of Daily Living (ADLs) will be evaluated, such as the patient's ability to walk without assistance, move from a bed or chair to standing position, bathe themselves, go to the bathroom on their own, dress themselves, and feed themselves.

In the state of Florida, these Medicaid rules apply:

- Benefits are not provided if just one ADL requires assistance

- If two ADLs require assistance, the cost of assisted living may qualify under a Florida Medicaid waiver program

- Benefits cover nursing home care if three or more ADLs require assistance

- Patients with dementia qualify for benefits for nursing home care

What If My Assets or Income Are Above the Limits?

If the applicant's monthly income is more than $2,382 a month and assets exceed $2,000 (married couples applying jointly have different limits), it is still possible to qualify for Medicaid benefits with a combination of careful financial and estate planning. Before you pay for the cost of a long-term facility out-of-pocket or deplete your savings, we encourage you to speak with our Medicaid lawyers by contacting our Ormond Beach or Palm Coast offices. We serve clients from Flagler County, Volusia County, and other areas of Florida, and we may be able to help you receive financial help without losing your assets. Car payments and qualified income trusts are just two of the places you can direct your money in order to meet the qualifications.

More Reviews from Satisfied Clients

My wife and I knew it was time to get serious about estate planning for the benefit of our family when we are gone. Scott Selis and his team has done an outstanding job of preparing our trusts, reviewing and rewriting our wills, and rewriting our property deeds to be in accordance with Florida law. The steps and the process they walked us through was organized and easy to understand. We highly recommend Selis Elder Law for your family estate planning needs. Larry B

Medicaid Attorney Services

Although it is not possible to apply for Medicaid benefits until the applicant meets the medical requirements, having a plan in place can reduce stress when the time comes for a loved one to go into a long-term care facility.

Pre-Planning

Many are unfamiliar with the concept of Medicaid planning; our lawyers can put a plan in place if there is a possibility that you or your loved one will need long-term care due to aging.

Our lawyers can develop a plan to reorganize your assets and income in a manner that complies with state Medicaid eligibility rules and other laws. This can bring your income and assets within the limits of the established guidelines so you can receive benefits for care. Families, married couples, and individuals can take advantage of Medicaid pre-planning so they can save money in the future.

Semi-Crisis Planning

Have you delayed planning only to realize an urgent need is quickly approaching? While Medicaid planning should be a key part of any long-term elder care strategy, many don't realize they may need it or they don't know they have the potential to obtain benefits until their loved one is already in need of nursing home care. Before you and your family start reorganizing your money to meet income and asset limits, it is critical that you meet with a lawyer that focuses on Medicaid planning so we can develop a comprehensive strategy that protects your assets and income when applying for benefits.

Crisis Planning

If your loved one is already in a long-term care facility, there are actions our elder law attorneys can take to help you receive assistance. Let us evaluate your options so we can see if we can help you obtain benefits and protect your financial freedom in the future.

Denied Benefits

Applicants may be denied benefits for a number of reasons. Eligibility requirements are constantly changing and submitting the proper paperwork can be challenging. Our attorneys can review your application and put a plan in place to help you get benefits.

We welcome clients from throughout Volusia County and the entire state of Florida.

Strategies to Qualify for Medicaid Long-Term Care Benefits

Whether you are in the pre-planning, semi-crisis, or crisis stage of planning your or your loved one's long-term care, there are a number of strategic moves we can make to redistribute your income and assets and help you obtain benefits:

Excess Income Can Go Toward Medical Bills

The Medically Needy Pathway program is designed for seniors that have high medical expenses, such as health insurance costs and medical bills. In this case, the cost of medical expenses can be subtracted from your income.

Excess Income Can Go In Qualified Income Trusts (QITs)

Our lawyers can set up this account and a portion of your monthly income is diverted into this account, reducing it to a level within Medicaid eligibility limits. A trustee is assigned and has legal control of the account. The account can only be used to pay for specific expenses, such as medical bills, personal needs allowances, and Medicare premiums. Further, any money that remains in the account upon the Medicaid recipient's death goes to the state of Florida.

Excess Income May Go to a Spouse

In certain situations, the spouse of the Medicaid applicant may be able to keep a portion of their spouse's income.

Excess Assets Can Be Spent on Uncounted Assets

An applicant can "spend down" their assets by making home modifications, paying down their primary home's mortgage, buying a new car, paying off other debts, or pre-paying for funeral and burial expenses.

Retitling and Transferring Assets

In some cases, our lawyers may recommend retitling and transferring some assets. However, if done incorrectly, this can go against the regulations established in the Florida Uniform Fraudulent Transfer Act. That is why it is so important to hire an attorney experienced in this area.

Avoid Gifting Assets

Gifting assets may be appropriate in some cases. However, there are strict rules regarding the amount of gifts that can be transferred each year. In addition, the agency that reviews your application will look back at any asset transfers over the last five years prior to your application submission. If any questionable transfers were made, you may be subject to a penalty period in which benefits aren't dispensed. In addition, gifting money in large amounts can be risky because death, disability, legal issues, divorce, and bankruptcy of the recipient can result in the money being lost for good.

We can implement the best strategy for your case. Our Daytona Beach-area offices are in Ormond Beach and Palm Coast, and we welcome clients from throughout Volusia County and the entire state of Florida. Contact us online to ask a question or request a consultation. You can also reach us by phone:

"Caring and Highly Capable."

Scott Selis helped create a trust for our family that lawfully protected our mother's VA benefit. We had previously engaged the services of another attorney who put together a trust that would not have served this purpose. Scott's know-how enabled her benefit to be protected, which enabled her to have the quality of life that we wanted for her. He also created a new will which served her and our family in the best way. At all times, Scott was caring, efficient, warm, and highly capable, as is his staff. I highly recommend Scott and his team for addressing anyone's elder law needs. Bonnie Bobbitt

Information We Submit During the Application Process

Our attorneys will need the following documentation for both the applicant and the applicant's spouse when submitting your Medicaid application from our Ormond Beach or Palm Coast offices:

Clients throughout Volusia County and the entire state of Florida can turn to us for help navigating this complex area of elder law.

Serving Clients in Flagler County, Volusia County, and throughout Florida

If you need a Medicaid planning lawyer in Florida, Scott Selis can provide you with the advice you need. We have helped people that live out of state, in other areas of the state, and throughout Flagler County and Volusia County make arrangements that benefit their loved ones.